Google’s stock poked above $1000/share last week as its advertising revenue peaked. Wall Street’s reaction was a little insane, which isn’t news, of course. But pumping up a $900 stock to $1000 does seem to pique curiosity and interest.

GOOG, the symbol for Google’s stock, was born during the height of the dot-com era, right around the time the dot-com bubble burst. As a victim of that bubble, I wasn’t about to buy any shares of GOOG, especially at the premium asking price of $100/share.

Of course, GOOG would have been a marvelous investment: If you spent $10,000 ten years ago to buy 100 shares of GOOG those shares would be worth $100,000 today. That’s a nice return. Figure 1 shows a chart of Google’s stock price over that timespan.

Figure 1. Google’s stock share price since its inception.

For comparison purposes, had you instead bought $10,000 worth of gold (the metal) in 2003 that gold today would be worth about $40,000. I hope that puts things into perspective for you.

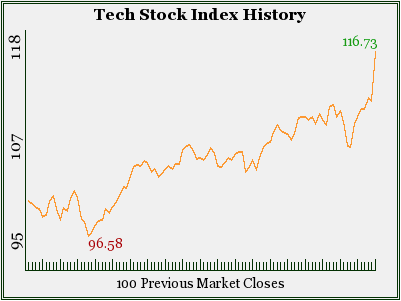

Figure 2 shows the full history of the Wambooli Tech Stock Index, which was born in May this year. The spike at the far right end of the chart is due to Google’s stock.

Figure 2. The effect of GOOG on the Wambooli Tech Stock Index.

My fear now, especially with GOOG soaring, is that greed is going to take over. This is not the time to buy Google stock; it’s a time to sell.

Yes, I’m not a financial advisor, but I’m still going to admonish any investor not to be greedy. Greed is an old story repeated often when it comes to investing. The sad end of that story is that the little guy gets burned.

Years ago it was Netscape stock that soared from 4 to 200. Then came Dell Computer, then Qualcomm. The list goes on and on: Stocks go up and people buy them forcing the price to go up even farther. It’s crazy, but then it ends. Suddenly.

Historically speaking, it’s the Dutch Tulip Bubble of 1637 all over again. Eventually the over-inflated stock price pops like a balloon. When it does, the Big Boy Investors will have been long gone. Those holding the bag will be small time investors, many of whom will have sank their live savings into an over-priced stock. Don’t be one of them! Just sit back and watch this time.